I think I judged a little too quickly on POSB myhome fund earlier.

I think I judged a little too quickly on POSB myhome fund earlier.The key attraction in this fund is actually the auto rebalancing feature that it offers. There are 2 plans to choose from, homesteady plan (20% in DBS STI ETF 100 and 80% in ABF Singapore Bond ETF) and homebalanced plan (50% into each).

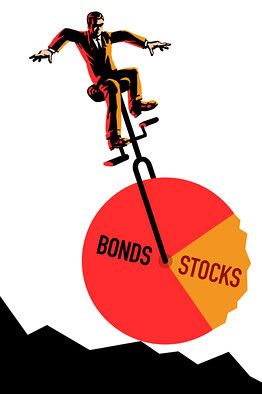

Now, since stocks and bonds usually go in different directions, when one zig, the other zag, having these 2 asset classes in your portfolio allows for a strategy called rebalancing. What this does is very simply balance your 2 ETFs back to the allocation you chose, say homebalanced, 50% into each. So when the stocks index is not doing well for example, the bonds index will probably produce more, making the portfolio imbalance. Now, what rebalancing does is, as the name suggests, balance it back to 50-50.

What this achieves is this, a portion of the bond index that is doing well are sold off at a price when it is high and this amount of income is reinvested into the not-doing-so-well stocks index, where it is now bought at a low price. And the reverse also applies. So, by regularly doing this rebalancing or should I say sell-high-buy-low between these 2 asset funds, you are maximizing your returns. This also forms the basis of why diversifying is so important; to allow you to sell whatever is high and buy whatever is low, increasing your returns and lowering the risk at the same time.

Of course, you can say that investors can rebalance their portfolios even if they buy the ETFs direct. But, for one thing, I think not many people have the discipline to do it. And also, it also incurs more cost when you sell and buy with brokerage. Now, this fund does it automatically and somewhat justifying the management cost. But it is if and only if we are talking about small investment, say less than 10k. Anything above that, the fees will be too much to chew on and you are better off doing it yourself.

Furthermore, I believe there is also a regular monthly investment option ($100 minimum) which can be seen as a saving cum investment thingy. But, what this option really helps to achieve is dollar-cost-averaging. This means, buying more units when the price is low and buying fewer units when the price is high. For example with a 100 dollars regular investment, the first month when the price is at $5, you buy 20 units. And comes next month, if the price decreases to $2, you buy 50 more units. The average price of the 70 units you bought with 200 dollars is thus averaged to $2.86. This means, you do not have to worry much about market timing.

So my opinion is that this product is good for investors with low starting capital or those who wants to invest little on a regular basis. Other than this, please do it yourself and do your own math..

2 comments:

hi i beginner in tis kinda thing, i find tis v helpful, so tks. but can u tell me how often shd i rebalance cos u cant rebalance evrey day rite?

Of course, you shouldn’t rebalance too often as you will probably not be able to take advantage of the volatility ride. And if rebalancing is done too rarely, then it would be defeating the purpose.

There are generally 2 schools of thought regarding how often one should rebalance. One way is through a fixed schedule. For example, once or twice or a few times a year depending on how aggressive your portfolio is and as long it's consistent.

Another way is to monitor your portfolio and rebalance as and when one asset class drifts too much away from the original allocation. For example, you set your tolerance to say give or take 20%. So if one falls out of this tolerance range, rebalancing should be employed. This is to make volatility and science of probabilities work to your advantage. Selling off your winners before they become loser; and buying in the losers before they become winners.

I also novice and still learning, so not really in any position to advice, please check out this site for more info. =)

Post a Comment